- Some investors have been worried about the sudden rise in interest rates over the past month.

- Higher interest rates have helped spark a rotation from high-growth technology stocks to more value-oriented sectors like energy and financials.

- But rising interest rates tend to be accompanied with rising stock prices, especially when these 3 factors are met, according to LPL.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A sudden spike in interest rates has accelerated the internal leadership change of the stock market over the past month, with high-growth technology stocks underperforming relative to more value-oriented sectors like energy and financials.

But rising interest rates have historically been accompanied by rising stock prices, especially when an improving economic growth outlook is part of what's driving rates higher, according to an analysis from LPL Financial.

"If an improving growth outlook is part of what's driving rates higher, it should also support corporate profits, creating a positive fundamental backdrop for stocks," LPL said in a note on Monday.

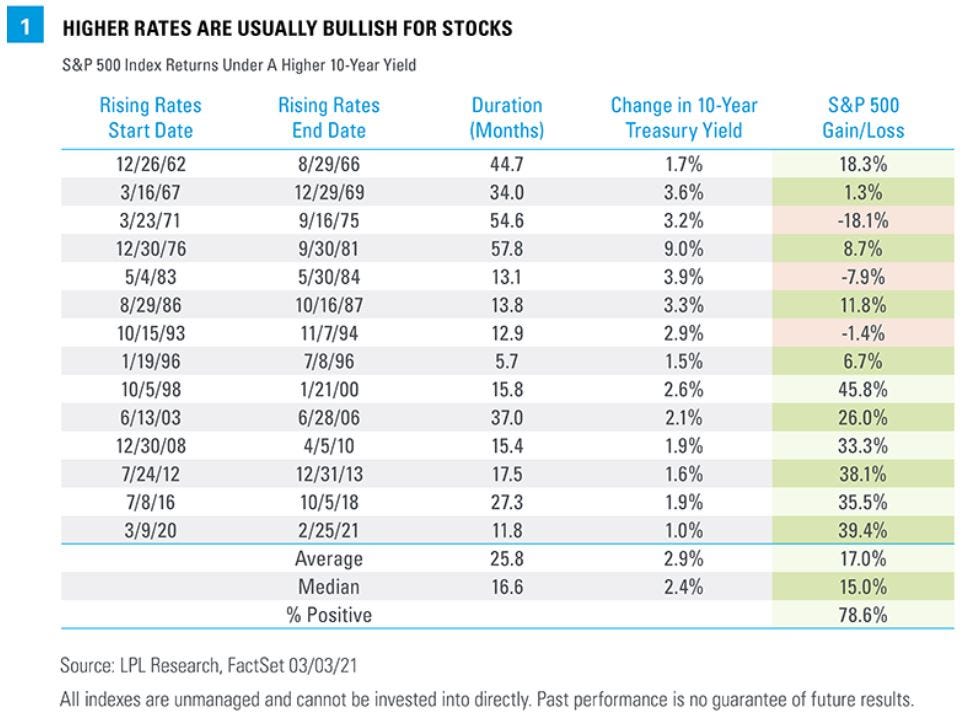

Based on historical data going back to the early 1960's, LPL found that of the periods in which the 10-year US Treasury yield rose by at least 1.5%, the stock market moved higher nearly 80% of the time, delivering an average return of 17% over an average time period of just more than two years.

Since the start of the year, the 10-year US Treasury yield increased by about 0.70% to its current standing of 1.59% as of Monday afternoon.

These are the 3 factors that need to be met during a period of rising interest rates for stocks to perform well, according to LPL.

1. "The starting point for interest rates is low."

"Rates have been rising but they are still historically low, with the 10-year Treasury yield at the end of February falling into the bottom 2% of all values dating back to 1962. While it's true that rates become a bigger burden for business, consumers, and governments as they rise, even at current and higher levels rates are still attractive and can continue to support a robust economic rebound," LPL said.

2. "We are not in an extended period of high inflation."

"Rising interest rates during periods of high inflation have generally resulted in lower stock returns," LPL said, pointing to its historical data.

"From 1968 to 1990, the consumer price index rose an average of 6.2% per year and was above 3.5% every year except three. Five of the rising rate periods took place at least partially during those inflationary years. The average annual return during those rising rate periods was -0.4%. During all other rising-rate periods, the average annual return was 13%, well above the average for all returns since 1962," LPL said.

3. "Rising rates are accompanied by strong yield curve steepening."

"The yield curve is the difference between long-term and short-term interest rates. A steepening yield curve usually tells us two things: economic growth expectations are picking up, pushing long-term rates higher; and the Federal Reserve probably is not yet pumping the brakes, helping to keep short-term rates relatively low, which usually also means inflation is under control," LPL explained, adding that stocks performed best during periods of rising interest rates when the yield curve saw the most steepening.

According to LPL, all three factors are being met in today's rising rate environment, which leads the firm to conclude that "stocks may tolerate the current rising-rate period well."